All Categories

Featured

Table of Contents

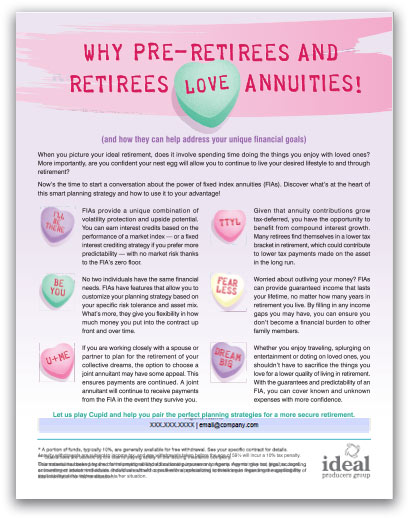

Like any type of financial investment item, annuities come with unique benefits and drawbacks: Annuities can supply guaranteed earnings permanently. Warranties are based on the claims-paying capacity of the life insurance coverage firm. Other retired life earnings choices have limitations on just how much you can deposit annually. Annuities do not. Because they're invested in a different way, annuities usually offer a greater guaranteed rate than various other products.

You won't pay taxes on the passion you earn up until you prepare to start receiving revenue from your annuity. You pay taxes when you get your annuity revenue, and no person can predict what the taxed rate will be at the time. Annuities can be challenging to recognize. You'll wish to work with an expert you depend on.

Who provides the most reliable Flexible Premium Annuities options?

Down payments into annuity contracts are normally locked up for a time period, where the annuitant would certainly sustain a fine if all or part of that cash were withdrawn. Each sort of annuity has its own unique advantages. Figuring out which one is appropriate for you will depend upon aspects like your age, danger tolerance and just how much you have to invest.

This product is a mix of its fixed and variable family members, and that makes it a bit extra difficult. The rates of interest paid to annuitant is based on the efficiency of a defined market index. With an indexed annuity, you have the possibility to make greater returns than you would certainly with a fixed annuity with more defense versus losses than with a variable annuity.

How much does an Retirement Annuities pay annually?

Due to their complexity, the choice to acquire an annuity is one you need to talk about with a professional. Since you recognize what an annuity is, contact your neighborhood Farm Bureau representative or consultant to understand your alternatives and develop a retired life strategy that works for you. An annuity is a contract with an insurance provider that offers tax-deferred passion and the capacity for an assured stream of earnings. Purchasing one can assist you feel a sense of monetary safety in retired life - Annuity interest rates. Yet there are likewise several various other benefits to take into consideration. One advantage to annuities is the reality that they can provide guaranteed revenue for a set number of years, and even for the rest of your life.

:max_bytes(150000):strip_icc()/Immediate-variable-annuity.asp-final-c62d88ef3f7a4b688c0303ef04e1fbce.png)

In reality, in these scenarios, you can assume of an annuity as insurance policy against potentially outliving your cost savings. For workers who do not obtain a pension plan, an annuity can assist fill that void. Workers can spend cash right into a pension (like an IRA) and after that, upon retired life, take those cost savings and purchase an annuity to supplement Social Safety.

What is the difference between an Guaranteed Return Annuities and other retirement accounts?

An additional large advantage supplied by annuities? All certified annuity withdrawals are subject to ordinary revenue tax, and withdrawals taken prior to the age of 59 will certainly incur an extra 10% tax charge The tax-deferred condition can permit your money to have even more development possibility or permit your cash to possibly expand even more over time due to the fact that earned interest can intensify without any type of funds needing to go towards tax repayments.

Unlike various other retirement options, there are no IRS restrictions on the amount of cash you can add to an annuity. The internal revenue service places caps on the quantity you can invest in an IRA or 401(k) yearly. For circumstances, the 2024 limit for an IRA is $7,000 a year or $8,000 if you're 50 or over.

Can I get an Retirement Annuities online?

1 However the Internal revenue service does not position a ceiling on the amount you can add to an annuity.

There are immediate annuities and postponed annuities. What this indicates is you can either acquire an annuity that supplies repayment within a year of your premium or an annuity that starts paying you in the future, normally upon retired life. There are likewise annuities that expand at a fixed price, or variable annuities that grow according to the efficiency of investments you have in a subaccount.

This is an area where annuity advantages might supply proprietors a benefit. With an annuity, you might have an alternative to acquire a rider that allows you to get higher payments for a set time duration if you call for long-lasting care.

It's just a guaranteed quantity of revenue you'll receive when the annuity gets in the payout phase, based on the claims-paying capacity of the insurance company. With any economic decision, it's great to recognize and evaluate the prices and advantages. If you want to understand what are the benefits of an annuity, remember it's a viable option to save tax-deferred cash for retired life in a way that suits your requirements.

How do Annuity Riders provide guaranteed income?

Lots of people choose to start receiving these repayments either at or at some time after retirement - Fixed-term annuities. Annuities have an entire host of names, based upon benefits and providing companies, but at their core, they are best recognized by their timeline (prompt or delayed) and whether they include market direct exposure (variable). A prompt annuity allows you quickly transform a lump sum of money right into a guaranteed stream of income.

Table of Contents

Latest Posts

Exploring the Basics of Retirement Options A Comprehensive Guide to Retirement Income Fixed Vs Variable Annuity Defining Choosing Between Fixed Annuity And Variable Annuity Pros and Cons of Various Fi

Highlighting the Key Features of Long-Term Investments A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Pros and Cons of Annuity Fixed Vs Variable Why Fixed Annuity

Analyzing Variable Vs Fixed Annuities Everything You Need to Know About Financial Strategies Defining Fixed Index Annuity Vs Variable Annuity Features of Fixed Annuity Vs Equity-linked Variable Annuit

More

Latest Posts